when are property taxes due in will county illinois

Will County has one of the highest median property taxes in the United States and is ranked 34th of the 3143 counties in order of median property taxes. Will County IL property tax due dates.

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

County boards may adopt an accelerated billing method by resolution or ordinance.

. It is managed by the local governments including cities counties and taxing districts. If you are a taxpayer and would like more information or forms please contact your local county officials. The property tax rate in Will County Illinois is 205 costing residents an average of 4921 per year.

Will County property tax due dates 2022. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section. How do I find my Illinois property tax pin.

Click Here for. 302 N Chicago Street Joliet IL 60432. Tax Sale Instructions for Tax Buyers.

Due dates will be as follows 1st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. 2nd Distribution to Taxing Bodies 2021 Levy. Checks or Money Orders should be made payable to the Will County Clerk.

Property taxesthey can feel like a burden especially in areas with high rates including Will County. Kane county illinois property tax due dates 2021 Thursday May 19 2022 Edit. Tax amount varies by county.

Penalty on Unpaid First Installment. The median property tax in Will County Illinois is 4921 per year for a home worth the median value of 240500. Idor Announces 2021 Kane County Tentative Property Tax Multiplier Kane County Connects Joyful Giving University Advancement 2020 2021 Annual Report By Indiana State University Issuu S2hogqzqrxcf7m.

173 of home value. Will County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Will County Clerks Office.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Will County Treasurer Tim Brophy said the board should establish June 3 Aug. Welcome to Property Taxes and Fees.

Payments can be made in person or by mail. Will Countys high property taxes are so high due to the over 8000 taxing authorities all. The Illinois Department of Revenue does not administer property tax.

It is important to maintain the countys tax cycle to ensure revenues are available to continue critical services for our residents. Tax amount varies by county. Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a.

Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs or to non ad-valorem taxes. Cook County and some other counties use this. For more information please visit the web pages of Will Countys Supervisor of Assessments and Treasurer or look up this propertys current valuation and.

2nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. 3rd Distribution to Taxing Bodies 2021 Levy. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

John Ferak Patch Staff Posted Fri May 22 2020 at 434 pm CT. Tax Sale Case Numbers. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

I understand and accept the above disclaimer. The state average is lower at 173. General Information and Resources - Find information.

In most counties property taxes are paid in two installments usually June 1 and September 1. Home - LaSalle Parish Assessor La Salle County You deserve to know how La Salle County property. The median property tax also known as real estate tax in Will County is 492100 per year based on a median home value of 24050000 and a median effective property tax rate of 205 of property value.

Will County collects on average 205 of a propertys assessed fair market value as property tax. Tax Sale Information for Property Owners. The PIN for the property should be written on the check.

Will Countys new schedule means half the first property tax bill is due June 3 and the second half is due on Aug. 2nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per. Due dates will be as follows 1st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted.

In order to keep Will County residents safe during the unprecedented COVID-19 crisis and offer convenient ways to pay Will County Treasurer Tim Brophy has announced alternate deadlines and methods to pay property taxes. 3 as the due dates for 2021.

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Dupage County Property Tax Due Dates

Tim Brophy Will County Treasurer

Online Payment System Tim Brophy

2nd Installment Of Real Estate Taxes Due Will County Illinois Home

Dupage County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Lookup Payments Dates

How Is A Tax Bill Calculated Tim Brophy

Will County Il Property Tax Getjerry Com

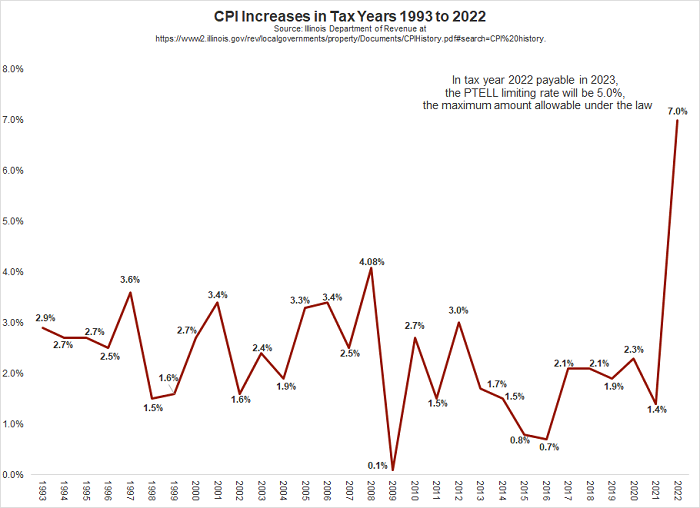

Property Tax Cap To Hit 5 Limit For First Time In 2022 The Civic Federation

Home Improvement Exemption Cook County Assessor S Office

Property Tax Village Of River Forest

![]()

Tim Brophy Will County Treasurer

Residential Effective Property Tax Rates Increased Across Cook County In Last Decade The Civic Federation

The Cook County Property Tax System Cook County Assessor S Office